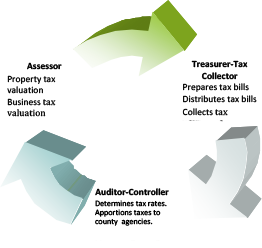

The Auditor-Controller’s role in the Property Tax cycle is to calculate tax rates and apportion the tax dollars. The Auditor-Controller’s Property Tax Section is responsible for the timely and accurate apportionment of property taxes to the County, cities, Redevelopment Trust Funds, school districts, and special districts.

Of the $6.2 billion property taxes paid by Orange County property owners County government receives 10.7% or approximately $660 million. While the Orange County Treasurer Tax-Collector sends the property tax bills and collects the payments, the Auditor- Controller allocates and distributes those collections to a wide variety of agencies in a process called apportionment. Property tax revenue is allocated according to property tax law to the County’s cities, school districts, water districts and a variety of special districts.